Hi - Dave here.

Happy Friday!

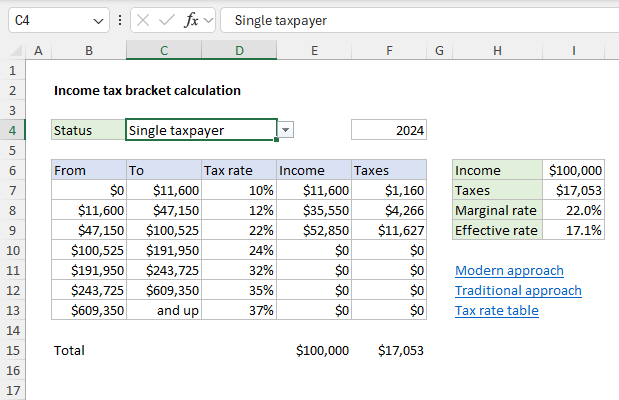

US taxes are due just around the corner in April, so I wanted to let you know that I've updated my income tax bracket calculation worksheet to include 2024 rates.

I've also modified the worksheet to store tax rates rates for different years. This means you can change the year to compare the effect of tax rate changes.

You can see what this looks like in the worksheet below, where both C4 and F4 contain dropdown menus:

[

Download the workbook and read the full explanation]

This is an interesting example of how tax rates for a progressive tax system are applied to taxable income. It also uses some advanced formulas to fetch the correct tax rates based on the selected filing status and tax year. Read the complete explanation and download the workbook at the link above.

Note: Sheet1 contains a "modern" solution that uses dynamic array formulas. This requires Excel 365. Sheet2 contains a "traditional" solution that should work in any version. Both approaches are explained in the article.

Excel formulas

We maintain a list of over 1000 working formulas

here.

If you need more structure, we also offer

video training.

Have a great weekend!

Dave

The Exceljet newsletter is free and sent weekly on Fridays. Each week, I take a detailed look at how to solve a specific problem with an Excel formula. You can sign up on our home page.